January 2025

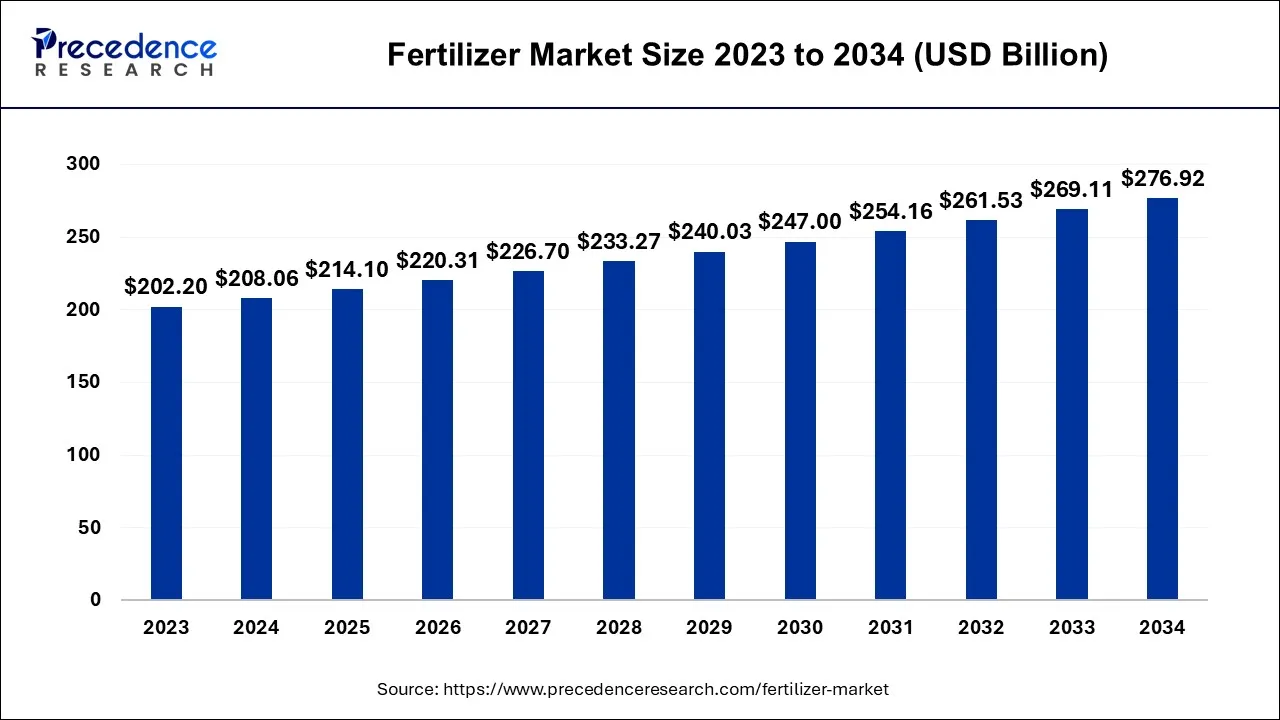

The global fertilizer market size accounted for USD 208.06 billion in 2024, grew to USD 214.10 billion in 2025, and is projected to surpass around USD 276.92 billion by 2034, poised to grow at a CAGR of 2.9% between 2024 and 2034. The Asia Pacific fertilizer market size is calculated at USD 104.03 billion in 2024 and is expected to grow at the fastest CAGR of 3% during the forecast year.

The global fertilizer market size is expected to be valued at USD 208.06 billion in 2024 and is anticipated to reach around USD 276.92 billion by 2034, expanding at a CAGR of 2.9% over the forecast period from2024 to 2034.

The Asia Pacific fertilizer market size is calculated at USD 104.03 billion in 2024 and is projected to be worth around USD 139.84 billion by 2034, poised to grow at a CAGR of 3% from 2024 to 2034.

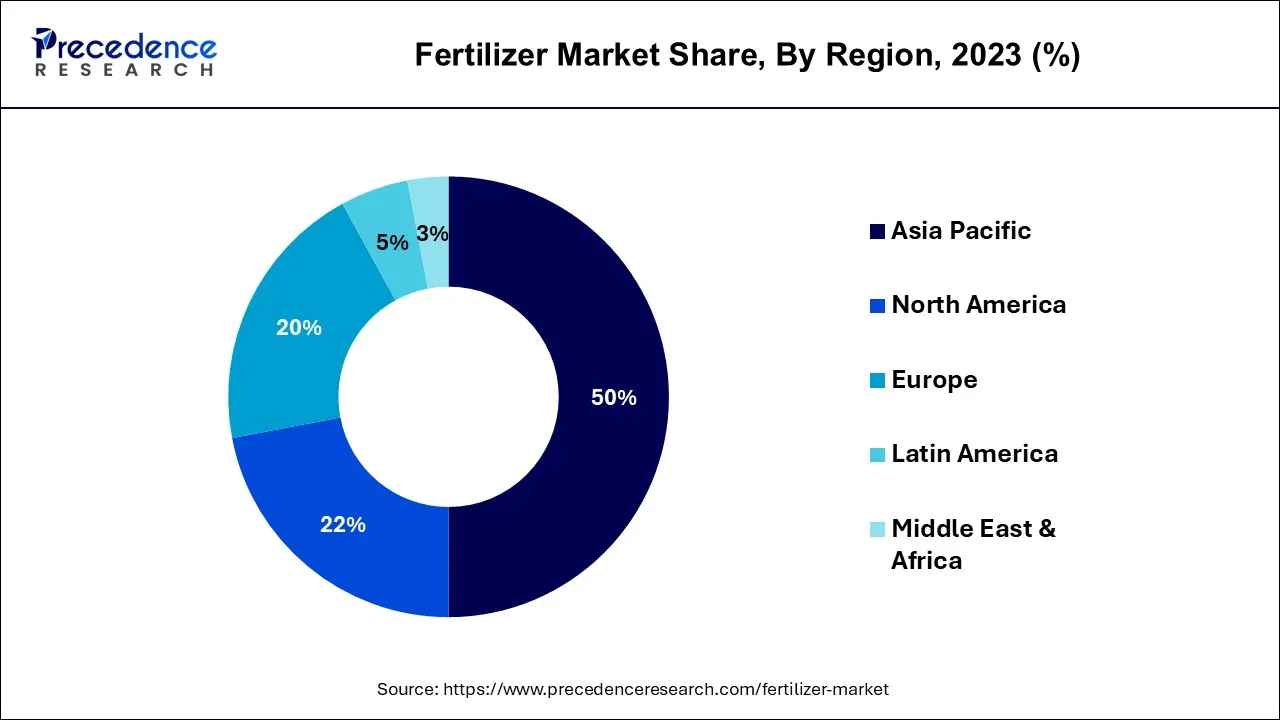

Asia-Pacific dominated the fertilizer market in 2023. The Asia-Pacific region is considered as largest region in terms of rice production. The rice requires nitrogen while cultivation process. The rice production represented for 36% of total fertilizer consumption in Asia in 2017. In 2020, India has projected to export rice worth around US$ 4 billion. Oil palm fertilizer accounted 17% of overall fertilizer consumption and 50% of potash usage.

The region growth is driven by increasing demand for food due to population growth and changing dietary patterns. As the population continues to grow, there is a pressing need to increase agricultural productivity to meet the rising demand for food. Fertilizers play a crucial role in modern agriculture by providing essential nutrients to crops, improving soil fertility, and enhancing crop yields. In addition, the adoption of modern agricultural practices and technologies in Asia-Pacific, such as precision agriculture techniques, is driving the demand for fertilizers.

Precision agriculture involves using data-driven and technology-based approaches to optimize crop production, including the precise application of fertilizers based on crop needs, soil conditions, and weather patterns. This trend is leading to a higher demand for specialized and customized fertilizers tailored to the specific requirements of different crops, which further drives the fertilizer market in the region.

Middle East & Africa Fertilizer market is expected to grow at a CAGR of 4% from 2024 to 2034. Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the fertilizer market in Europe region. The growth of fertilizer market in Europe region is being driven by the surge in demand for organic products. In addition, rising disposable income are also driving the growth of Europe fertilizer market. Moreover, the technological advancements is creating demand for fertilizer in Europe region.

The growing population is emphasizing the expansion of agriculture sector. As per the United Nations, the worldwide population will surpass nine billion people by 2050. In addition, as per the Food and Agriculture Organization, more than 70% of the global population will live in cities by 2050. The farmers are being forced to use fertilizers to enhance their agricultural output due to loss of arable land across the globe. As a result, the growing population is expanding the global fertilizer market over the forecast period.

As the need for smart agriculture grows, different governments in emerging and established nations have taken steps to encourage farmers to convert their land to organic. For example, the European government has set aside 30% of its CAP policy’s rural development budget to assist organic farming. The governmental activities that is likely to benefit the sales of organic fertilizers in the coming years to come include market findings, capacity growth, targeted subsidies, and research assistance for organic farming. Thus, the surge in demand for organic fertilizers is contributing towards the growth of global fertilizer market.

| Report Coverage | Details |

| Market Size in 2024 | USD 208.06 Billion |

| Market Size by 2034 | USD 276.92 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 2.9% |

| Asia Pacific Market Share in 2023 | 50% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Form, Application, Product, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing Global Population and increasing demand for food

The global human population has experienced a staggering increase, surging to over three times its size in the mid-twentieth century. According to United Nations, as of mid-November 2022, the estimated global population reached 8.0 billion, a significant leap from 2.5 billion in 1950. In just over a decade, the world population has grown by 1 billion people, and in just over two decades, it has skyrocketed by 2 billion. Projections indicate that the world's population is expected to continue to rise, with an estimated increase of nearly 2 billion individuals over the next 30 years, reaching 9.7 billion by 2050 and possibly peaking at nearly 10.4 billion in the mid-2080s.

As the world population continues to rise, there is a pressing need to increase agricultural productivity to meet the expanding demand for food. Fertilizers play a critical role in modern agriculture as they provide essential nutrients to crops, improve soil fertility, and enhance crop yields. Moreover, changing dietary patterns and the shift towards more protein-rich diets in emerging economies are fueling the demand for animal feed, which, in turn, is boosting the need for fertilizers used in forage and pasture production. Furthermore, the adoption of modern agricultural practices and technologies, such as precision agriculture techniques, is increasing the emphasis on using fertilizers for optimized crop production.

Rising Focus on sustainable agriculture and environmental concerns

Specialty fertilizers, including organic and bio-based fertilizers, are gaining popularity due to their eco-friendly nature, aligning with the increasing consumer demand for environmentally friendly and sustainable products. Moreover, government policies and subsidies that promote the use of fertilizers to increase agricultural productivity also impact the fertilizer market. Many governments worldwide provide subsidies or incentives to farmers, which accelerate demand for fertilizers and positively impact the market. Additionally, weather conditions and climate change, such as extreme weather events and changing weather patterns, disrupt agricultural production and result in increased demand for fertilizers to restore soil fertility and support crop growth.

Environmental Constraints

The increasing global population and its demand for resources, energy, and food have detrimental effects on the environment. Overexploitation of natural resources, such as forests, fisheries, and water sources, lead to depletion and loss of biodiversity, disrupting delicate ecosystems and posing long-term sustainability challenges. Deforestation, driven by agricultural expansion, logging, and infrastructure development, contributes to habitat destruction, loss of carbon sinks, and climate change. Pollution from industrial and agricultural activities, including air and water pollution, degrades ecosystems, harm human health, and damage biodiversity. Climate change, caused by greenhouse gas emissions, has far-reaching consequences on weather patterns, sea-level rise, extreme weather events, and natural disasters, affecting agriculture, water resources, and vulnerable communities.

Social and Economic Constraints

Social and economic constraints impede progress and development. Socio-economic inequalities, including disparities in income, education, healthcare, and access to basic amenities, limit opportunities for certain groups and hinder social mobility. Poverty, particularly in developing countries, results in food insecurity, malnutrition, and inadequate access to clean water and sanitation. Unemployment, underemployment, and lack of economic opportunities leads to social unrest and undermining social cohesion and stability. Political instability, conflicts, and legal/regulatory barriers hinder governance, human rights, and rule of law, leading to social and economic constraints.

Sustainable and Green Technologies

The development and adoption of sustainable and green technologies present significant opportunities for addressing environmental, social, and economic challenges. Renewable energy technologies, such as solar, wind, and hydropower, offer alternatives to fossil fuels, reducing greenhouse gas emissions, mitigating climate change, and promoting sustainable energy production. Sustainable agricultural technologies, including precision farming, organic farming, and agroforestry, can improve soil health, enhance crop yields, reduce chemical inputs, and promote biodiversity. Circular economy practices, such as recycling, upcycling, and waste reduction, can contribute to resource conservation, reduce pollution, and create economic opportunities. Smart and green urban planning and infrastructure, such as green buildings, public transportation, and sustainable waste management, enhances quality of life, reduce carbon emissions, and improve resilience to climate change.

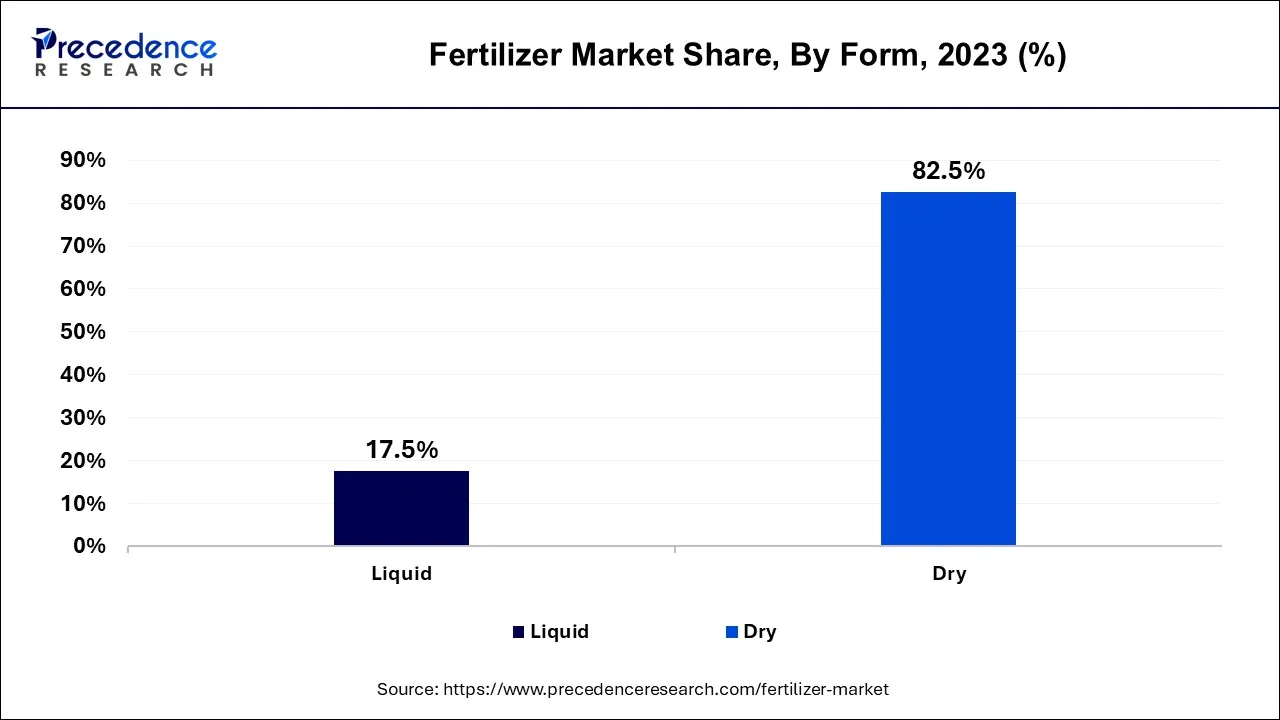

The dry fertilizer segment accounted largest market share in 2023. Dry fertilizers are solid fertilizers that come in granulated or powdered form, and are widely used in agriculture for field crops, such as grains, cereals, and oilseeds. One of the main factors driving the demand for dry fertilizers is their cost-effectiveness. Dry fertilizers are generally less expensive to produce, transport, and store compared to liquid fertilizers. They can be easily stored for longer periods without the need for special storage facilities, which results in cost savings for farmers and distributors. Additionally, dry fertilizers are easy to apply using various types of equipment, such as spreaders, seeders, and planters, making them convenient for farmers. The most significant advantage of a dry fertilizer is that it absorbs slowly in the soil. It is commonly used in large fields as it lasts longer than any other fertilizer. Furthermore, using a dry fertilizer rather than a liquid fertilizer, which gradually burns plants, has a much lower risk of harming plants and crops.

The liquid fertilizer segment is fastest growing segment of the fertilizer market in 2023. The surge in demand for high efficiency fertilizers, the convenience of use and administration of liquid fertilizers, and the acceptance of precision agriculture and irrigated agriculture are some of the drivers expected to propel the growth of the segment.

The organic segment garnered the largest revenue share in 2023. The organic fertilizers are mineral sources that are found in nature and include a moderate amount of plant needed nutrients. They are capable of resolving issues caused by synthetic fertilizers. They lessen the need for synthetic fertilizer applications to maintain soil fertility. They slowly release nutrients into the soil solution while maintaining nutritional balance for plant and crop growth.

The inorganic segment is fastest growing segment of the fertilizer market in 2023. The minerals and synthetic chemicals are used to make inorganic fertilizer. The petroleum is a popular source of inorganic nitrogen. Inorganic fertilizers are high in macronutrients such as potassium chloride, ammonium sulphate, and magnesium sulphate. Because the phosphorus, potassium, and nitrogen mix can provide quick treatment, some gardeners find inorganic fertilizer useful for rescuing starved plants. Inorganic fertilizers are chemically synthesized and typically contain essential nutrients in concentrated forms, such as nitrogen, phosphorus, and potassium, which are crucial for plant growth. They are widely used in modern agriculture and horticulture practices due to their effectiveness and availability in various formulations that cater to specific crop requirements. Inorganic fertilizers are commonly used in large-scale agricultural production which drives the growth of this segment. Moreover, inorganic fertilizers have a longer shelf life and can be stored for a longer period without losing their effectiveness, making them convenient for transportation, storage, and application. This allows for efficient distribution and use in various agricultural and horticultural practices. The growth of this segment is driven by the high demand for high-yielding and consistent crop production to meet global food demand.

The agriculture segment held the highest revenue share in 2023. The three essential plant nutrients, potassium, nitrogen, and phosphorus are found in most fertilizers used in agriculture. The certain micronutrients such as zinc are also present in some fertilizers and are required for plant growth. Natural fertilizers are materials that are put to the ground with the goal of improving soil properties. Fertilizers are primarily used in agriculture to enhance soil fertility and improve crop yields. Agriculture includes the cultivation of various field crops, such as grains, cereals, oilseeds, and fiber crops, as well as specialty crops, such as fruits, vegetables, and nuts. Fertilizers play a critical role in modern agriculture by providing essential nutrients to crops, promoting healthy plant growth, and maximizing crop productivity. Farmers extensively use fertilizers in agricultural practices to optimize crop production and achieve higher yields, contributing to the dominant demand for fertilizers in the agricultural sector.

The horticulture segment is the fastest growing segment of the fertilizer market in 2023. The fertilizers used for horticulture are very essential for the growth of plants. They provide large number of nutrients to the crops and results into rapid growth of plants. As a result, the growing importance of using fertilizers is driving the growth of the segment during the forecast period. Furthermore, Horticulture segment is expected to grow during the forecast period. Horticulture involves growing fruits, vegetables, flowers, and ornamental plants. These crops have specific nutrient requirements, and fertilizers are used to supplement them for healthy growth

Segments Covered in the Report

By Form

By Application

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

June 2024